And what will you use it for?

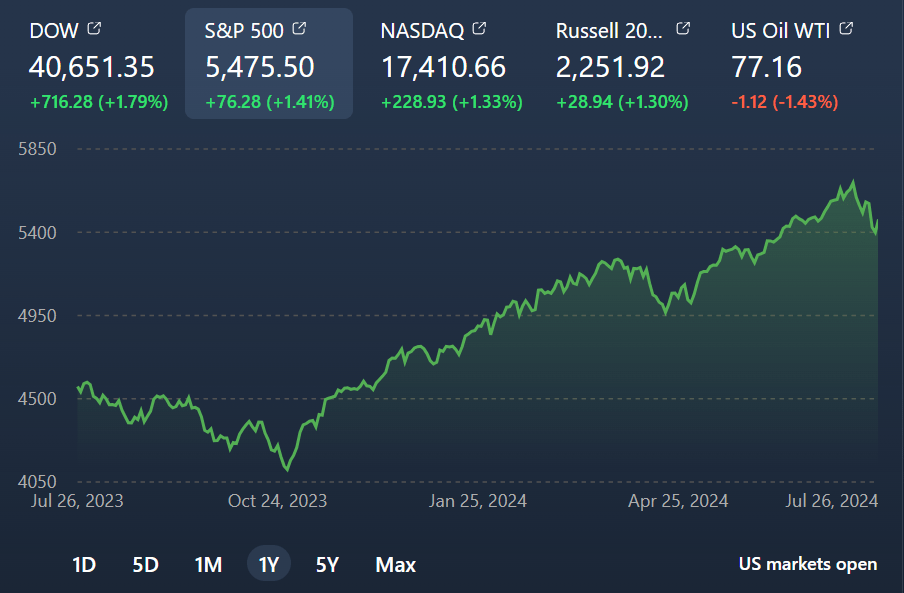

If you follow the markets at all (especially in the past few months), you’ve probably noticed a decent amount of volatility.

A huge run-up over the past year…

Followed by some large recent drops.

But how can you protect yourself from this type of volatility?

By setting a protected value!!!

Job loss, health problems, and family emergencies are just a few of the ways that life can punch you in the face. For those of us fortunate enough to create financial plans, we can try to be proactive to try and protect ourselves by creating a protected value.

In this article, we will go over a few things, including:

- What a protected value is

- Why to set a protected value

- How to set a protected value

In the future, I may write an article about how to try and maintain this protected value.

What is a protected value?

A protected value is simply a liquid (or accessible) asset level that one aims to maintain in order to not run out of money over a set period of time. Accessible assets would include 401K if you’re 59.5, but otherwise, this would just include cash and investments (more later in the article).

There are two schools of thought as far as the “ideal” money management scenarios:

- Spend down money perfectly until death (Die with Zero)

- Grow your wealth until you die

Creating a protected value hedges both strategies by not spending quite everything you have, but also opening yourself up to opportunities to spend if/when the protected value is exceeded.

Why set a protected value?

Setting a protected value is important – not only for folks who are ready for retirement, but also for people who plan to take an extended break from work or have a job in a volatile industry. The list of volatile industries (especially today) is too long to list, so I’ve noted some relatively non-volatile industries below which include:

- Healthcare

- Government

- Trades (carpentry, plumbing, HVAC, etc.)

If you’re not in any of the above industries, you should be setting a protected value! The value doesn’t have to be large, especially if you don’t have a high burn rate (monthly expenses). For example, a single person in NYC working in food service may have a volatile gig due to the cyclical nature of the restaurant business, but he/she may have a low burn rate due to low rent costs (having roommates), low commuting costs (NYC MTA), and low food costs (hookups from workplace + friends in the industry) . Additionally, this person’s risks are likely somewhat offset by being able to quickly get a gig at another restaurant. We will go into more details on how to set a protected value below.

How to set your protected value

In the clip above from “The Gambler,” , John Goodman’s advice to hunker down and tell everyone to f*** off was upon reaching $2.5M in assets. “You get a house with a 25 year roof, an indestructible Japanese economy shitbox, you put the rest into the system at 3-5% to pay your taxes and that’s your base, get me? That’s your fortress of fuckin’ solitude, that puts you at the rest of your life, at a level of fuck you.” This movie was released in 2014, so in current dollars, this would be approximately $3.3M during the ZIRP era, so risk-free returns were basically zero back then. However, today, 6-month treasury bills are yielding approximately 5%, so if you can live off of $125K/year (5% yield off of $2.5M excluding inflation assumptions), Goodman’s advice rings true. Even with 3% inflation factored in, this person could chill for 30 years or so before running out of money.

So, how do you determine this number for yourself?

IMO, it boils down to three things which you can then put in a formula to calculate your buffer:

- Liquid (or accessible) assets on hand

- Burn Rate

- Time to next gig/income stream

1. Liquid/accessible assets on hand

What are your liquid/accessible assets on hand? This would include cash held in bank accounts, investments in taxable brokerage accounts (Schwab, Robinhood, Vanguard, etc.), and any other assets you can easily part with to generate cash. I would exclude 401Ks (unless you’re 59.5 years old), IRAs, and any other assets that are inaccessible without paying penalties/interest. If you sign up for a financial tracking tool such as Monarch Money, you can easily track and consolidate your financial assets (specifically ones tied to online accounts).

For investments, I generally recommend folks to invest in the S&P 500, which is an index of the 500 largest companies traded on US stock exchanges.

As for cash, you should be making a return on it through a HYSA (High Yield Savings Account). Some good ones include Robinhood (yielding 5% with Gold) or Apple Cash (yielding 4.4%).

Once you calculate the amount, you can make an assumption of your annual return on these cash/investments which would then be used in the calculation.

2. Burn Rate

Next, take a look at how much you spend (on average) every month. Monarch Money makes it easy to sort by categories, groups, or merchants. This is actually also a great way to take stock of how much you’re spending every month on each category to see if there are opportunities to cut down! Some categories may be relatively fixed (like rent if you have a yearly lease) whereas others (such as restaurants, etc.) *may* be modifiable. I consider eating a hobby, so I don’t have plans to slow down my consumption (literally) anytime soon!

3. Time to next gig

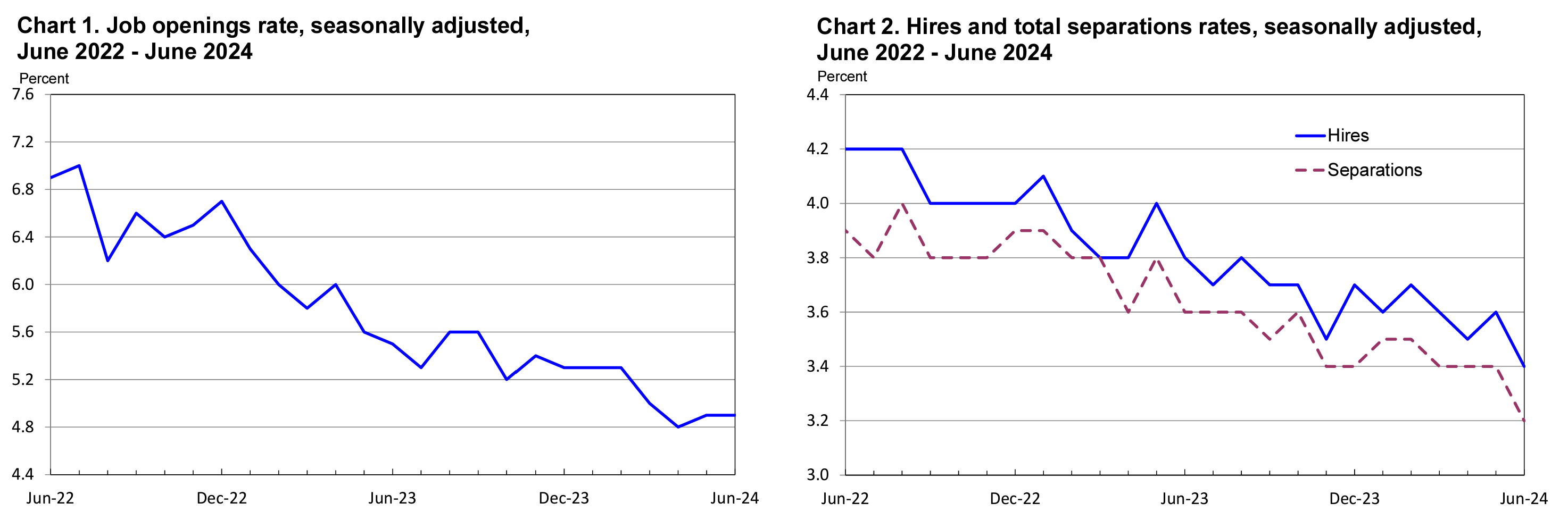

How long will it take you to get your next job? This one is a bit trickier. If you’re in food service and live in a city like NYC, it should be relatively easy to find work. However, if you’re in a corporate role, things seem to be pretty difficult out in job hunting land – I know of plenty of talented individuals who have been unemployed for 6+ months. Before the market got weird (once ZIRP ended sometime mid 2022-ish), folks earlier in their career trajectories (1-10 years experience) were able to land on their feet within 3-6 months. These days, regardless of tenure, you may be a free agent for longer than you intend. I’m pretty conservative about this type of thing; once I left my gig in April of this year (2024), I prepared to be unemployed for at least 1-2 years. As you can see below, job openings and hires have plummeted over the past few years as companies struggle to decide on what to spend their cash on (which they have plenty of, btw).

4. Calculation

Once you get your aforementioned numbers (Liquid/accessible assets on hand/return on these assets, monthly burn rate, and time to next gig), you can calculate your protected value!

We’ll start with a simplified formula:

Liquid Assets % Burn Rate = Time to Next Gig

We can substitute X for any one unknown variable.

So for example, if you have 6 months until you need a new gig and $1,000/month in burn rate, you need $6,000 in protected value ($6,000 % $1,000 = 6 months). In the formula above, it would look like this:

X % $1000 = 6 Months – solve for X! (Don’t worry if you don’t remember how to do this – just reach out and I can help you!)

We don’t really need to use return in this equation because the principal amount ($6,000) will generate negligible returns.

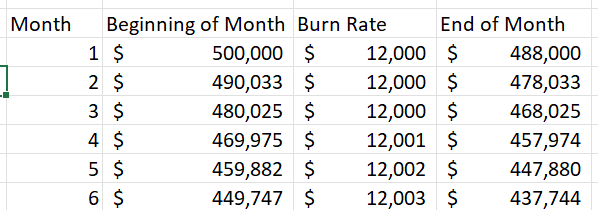

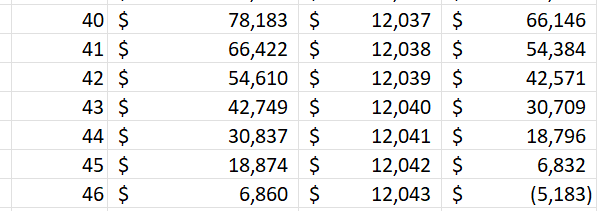

However, if you have a bit more in liquid assets, the return you generate on your capital can extend your runway for a bit. We’ll switch it up here and use Excel to calculate runway. For example, if you have $500,000 of liquid assets (which may be more accurate for you mid-career types), 5% return annually (which would be a 0.4% return monthly) and a $12,000 burn rate, the spreadsheet would look like this:

Here is the spreadsheet if you’d like to edit with your own numbers:

I hope this was helpful to you! As always, please reach out with any comments/concerns/rhetorical remarks. Might do a future article on use cases + how to try and maintain protected value. Holla if interested!

Leave a comment